Unlocking Homeownership: Exploring FHA Loans for Foreclosed Properties

The dream of owning a home can feel out of reach, especially for first-time buyers. But fret not, aspiring homeowners! Enter the “Foreclosure + FHA Loan” combo, a powerful duo paving the way to affordable homeownership even with limited down payment funds. While this might sound like a dream`, navigating the specifics of buying a foreclosure with an FHA loan requires knowledge and careful planning. So, buckle up as we crack open this treasure chest of possibilities!

Can You Buy a Foreclosed Home with an FHA Loan?

Yes, You Can Buy a Foreclosure with Your FHA Loan (But…)

The good news first: you can absolutely purchase a foreclosure using an FHA loan. These government-backed mortgages boast lower down payment requirements (as low as 3.5% for qualified borrowers!), making them highly accessible for those just starting out on the property ladder. But don’t let the excitement cloud your judgment – there are some crucial “buts” to consider:

- The property must meet FHA minimum standards. Think solid foundation, functioning plumbing and electrical systems, and a lack of major structural or safety hazards. A pre-purchase inspection is non-negotiable here.

- It needs to be habitable. Leaky roofs, missing windows, or a crumbling porch won’t cut it. The property should be livable without requiring immediate and extensive repairs.

- Government-owned foreclosures (REOs) often have stricter qualification requirements. These properties, managed by the Department of Housing and Urban Development (HUD), might require higher minimum credit scores or longer waiting periods after certain foreclosure situations.

- You must first qualify for an FHA loan.

So, how does the actual process work?

Firstly, you must get pre-approved for your FHA loan. This crucial step determines your borrowing power and ensures you’re on track before diving into the foreclosure pool.

- Getting approved: To qualify for an FHA loan in 2024, you must have:

- Minimum 580 credit score

- Two year work history

- Maximum 800 credit score

- Find your dream foreclosure: Scour online listings, connect with real estate agents specializing in foreclosures, and don’t shy away from attending auctions. Remember, competition can be fierce, so be prepared to act fast!

- Get the property inspected: An FHA-approved inspector will scrutinize the home, ensuring it meets the minimum standards and highlighting any potential repair needs.

- Negotiate, negotiate, negotiate: Foreclosures often offer wiggle room on price, especially if they’ve been sitting on the market for a while. Hone your negotiation skills and remember, patience is key.

- Closing time: Once all paperwork is signed and ducks are in a row, prepare to celebrate! Your very own home awaits, ready to be transformed into your haven.

Is Buying a Foreclosure with an FHA Loan Right for You?

On the plus side:

- Significant cost savings: Lower down payments through FHA loans combined with potentially lower foreclosure prices can be a budget-friendly win.

- Wider property access: Foreclosures open doors to diverse neighborhoods and housing styles you might not otherwise afford in the current market.

- Fixer-upper potential: For DIY enthusiasts, the opportunity to renovate and personalize a home at a bargain price can be a thrilling project.

Challenges to consider:

- Competition: Be prepared to battle seasoned investors and cash buyers who might have an edge in bidding wars.

- Potential repair costs: Factor in renovation expenses when calculating your overall budget. Hidden issues uncovered during the inspection might add to the initial price tag.

- Stricter property requirements: Compared to conventional loans, FHA-backed purchases have stricter property standards, potentially limiting your options.

- FHA loan requirements:

- All FHA loans require borrowers to pay mortgage insurance

- There is a limit on the maximum loan amount based on the average property value in the surrounding area

What to expect from Mortgage Insurance Premiums (MIP):

The price of mortgage insurance will be the same regardless of your credit score, but will increase slightly if you put down less than 5%. The policy requires an upfront payment at closing, as well as monthly payments, however the upfront payment may be rolled into the loan amount and paid through a slightly increased monthly principal payment.

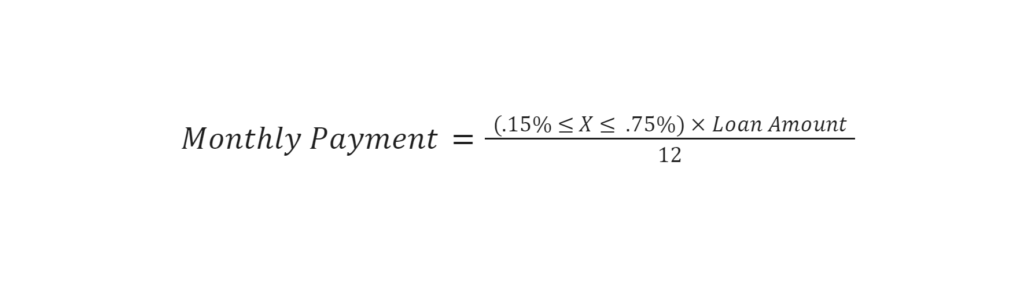

As of May 3rd 2023, upfront payments are 1.75% of the FHA loan amount, and monthly payments range from .15% to .75% annually (divided by 12) of the loan amount, depending on the down payment and loan amount. Your monthly premium payment amount can be calculated using the following equation, where X is equal to your annual MIP rate:

If the loan originated before June 2013, the insurance can be canceled once the borrower reaches 78% equity on the FHA loan. After June 2013, if the borrower puts down less than 10% of the property value, mortgage insurance must be paid for the life of the loan. If you put down more than 10% at closing, MIP can be canceled after 11 years of completed payments.

Can you score a fantastic deal on a foreclosure with an FHA loan?

Absolutely! But thorough research, a healthy dose of realism, and expert guidance from experienced real estate professionals and mortgage lenders are essential. Remember, knowledge is power – the more prepared you are, the smoother the journey will be.

Some fun facts about FHA loans and foreclosures:

- FHA-insured loans accounted for nearly 80% of all first-time homebuyers in 2023!

- Foreclosed properties often sell for 10-30% below market value, offering significant savings potential.

- Anyone can qualify for an FHA loan, not just first time home buyers

- If you are buying a property for rental income, 75% of the estimated monthly income can be applied to your debt to income ratio calculation

Remember, every foreclosure is unique, so thorough market research and property comparisons are crucial to ensure a good deal.

Ready to unlock your homeownership dreams with a foreclosure and an FHA loan?

Here are some actionable tips:

- Connect with a reputable real estate agent specializing in foreclosures. Their expertise can navigate you through the process and uncover hidden gems.

- Stay informed about local foreclosure listings. Sign up for email alerts and attend open houses to stay ahead of the competition.

- Get pre-approved for your FHA loan well in advance. This will give you an edge in negotiations and demonstrate your seriousness as a buyer.

- Be prepared to move fast. Foreclosures often move quickly, so having your finances and paperwork in order is key.

- Don’t be afraid to negotiate. Foreclosure sellers are often motivated to sell quickly, so don’t hesitate to make an offer below the asking price.

Bonus Tip: Consider researching and comparing different FHA lenders to find the best interest rates and loan terms for your situation. A few percentage points saved on your mortgage can translate into significant savings over the life of the loan.

In Conclusion

Buying a foreclosure with an FHA loan can be a fantastic way to achieve homeownership with little money down. With careful planning, smart negotiation, and the right guidance, you can turn a potential challenge into the key to unlocking your dream home at an affordable price.

While FHA loans are the cheapest way to buy a foreclosed home, they can only be issued for properties inside the United States. Urban Capital specializes in bringing the most profitable foreclosures Mexico has to offer, at the best price, to an international market of real estate investors. To find out more, check out our available foreclosures here, or get in touch to find out how you can expand your investment portfolio today.